Assembling Your Team

Preparing to list your New Y ork City townhouse, cooperative, or condominium for sale requires careful planning and attention to detail to ensure you present your property in the best possible light. Sotheby’s International Realty offers this Seller’s Guide as a roadmap to make the process seamless.

SELLER'S AGENT

A seller's agent plays is crucial in helping homeowners sell their property quickly and at the best possible price. The most important qualities for a seller's agent include:

MARKET EXPERTISE: A top-quality seller's agent should have an in-depth understanding of the local real estate market, including recent sales, pricing trends, and neighborhood dynamics.

NEGOTIATION SKILLS: Negotiation is a key aspect of real estate transactions. A skilled seller's agent should be able to negotiate confidently on the seller's behalf to secure the best possible deal.

MARKETING SAVVY: The agent should have a solid marketing strategy to showcase the property's strengths, using professional photography, virtual tours, and effective online and offline marketing techniques.

NETWORK AND CONNECTIONS: A well-connected agent can leverage their network of other real estate professionals, potential buyers, and other agents to promote the property and attract more potential buyers. Buyers may be local but often they come from out of state or out of country and your broker should have a global reach.

CLIENT-CENTRIC APPROACH: A seller's agent should prioritize the client's needs and objectives. Their actions and recommendations should be aligned with helping the seller achieve their goals.

REAL ESTATE ATTORNEY

A real estate attorney ensures a smooth and successful property transaction. In New York, attorneys prepare the contract of sale and negotiate critical deal points with the buyer’s attorney. The real estate attorney also coordinates the closing with the buyer’s attorney. It is important to find an attorney who is experienced in the sale of residential property in New York City and exhibit the following qualities:

EXPERIENCE AND EXPERTISE: Look for an attorney with substantial experience in New York residential real estate law. Familiarity with local regulations, practices, and market dynamics is essential. An attorney familiar with city-specific regulations, zoning laws, and transaction nuances is invaluable.

NEGOTIATION SKILLS: A skilled negotiator can advocate for your interests, whether you're buying, selling, leasing, or resolving disputes.

COMMUNICATION: Clear communication is crucial. Your attorney should explain legal terms and processes in a way you understand and keep you informed throughout.

RESPONSIVENESS: Timely communication is key in real estate transactions. Your attorney should promptly respond to your questions and concerns.

PROBLEM-SOLVING: Real estate deals can encounter obstacles. An attorney who can think creatively and find solutions is essential to keeping the transaction on track.

As your Real Estate Broker

Sotheby’s International Realty will work with you to curate a pricing, sales and marketing strategy, bring your home to market locally and globally, conduct showings, follow-up with leads and provide consistent and ongoing feedback until we have secured a qualified buyer at the highest and best price. Below are some steps you can take to lead to a successful sale:

DECLUTTER AND DEPERSONALIZE: Clear out unnecessary items and personal belongings to create a clean, spacious environment that allows potential buyers to envision themselves in the space.

DEEP CLEAN: Give your home a thorough cleaning, paying attention to every corner, surface, and fixture. Consider hiring professionals for a deep cleaning if needed.

REPAIRS AND MAINTENANCE: Address any necessary repairs, from minor fixes to major issues. Ensure all systems (plumbing, electrical, HVAC) are in working order.

STAGING: Consider professional staging to showcase your home's best features and create a welcoming ambiance.

FRESH PAINT: A fresh coat of neutral paint can instantly refresh your home's appearance and appeal to a wider range of buyers.

LEGAL AND FINANCIAL PREPARATION: Consult with your attorney and financial advisor to understand the implications of selling and plan for a smooth transaction. Take the time to close any open permits prior to listing the apartment to avoid delays.

Terms & Fees To Know

ASSESSMENTS: An amount of money that a condominium/ cooperative trust needs owners to pay in order to finance a project or outstanding debt that was not part of the annual budget/ assessment. These projects are for the common good of the building whether it be hallways, lobbies, roofs, mechanical systems, water or even the building façade.

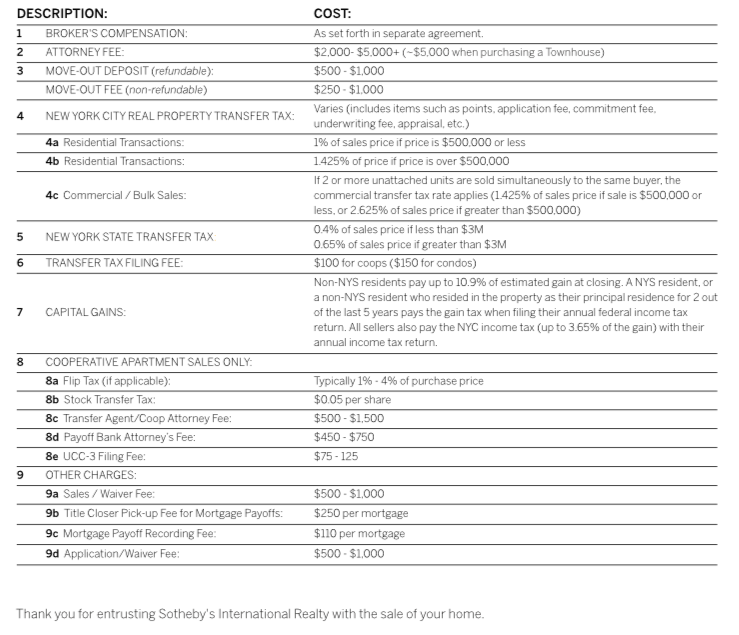

CLOSING COSTS: Fees paid at the real estate closing when the property is officially transferred from the seller to the buyer. Both buyer and seller can incur closing costs.

ESCROW: Deposit or down payment a buyer puts into the custody of a neutral third party like a title company, broker, or attorney to hold until the deal is closed. Once the deal is closed and the terms of the contract are met, the sum can be paid out to the seller.

FLIP TAX: A fee paid by a seller or buyer when purchasing in a co-op. It is not a government tax. It is a transfer fee to profit the building on the sale on an apartment. Flip tax can be negotiated or a co-op will have a strict rule on whether buyer or seller pays.

MORTGAGE CONTINGENCY: A provision in a purchase contract saying that if the prospective buyer cannot get a mortgage within a fixed period of time with the specified terms, the buyer can call off the whole deal and get back his deposit.

PROPERTY TAX ABATEMENTS: The government grants a reduction or exemption from taxes for a specific period in order to stimulate real estate or industrial development. The most common is 421a - this exemption lasts for 10 years, giving owners a 100 percent exemption from any increases in their real estate taxes for two years, then phasing out the exemption by 20 percent every two years over the remaining eight years. In Upper Manhattan and the outer boroughs, the exemption can last for 15 or 25 years.

REAL ES TATE TAXES: For a condo, this is a separate NYC tax bill.